Adobe Just Posted a Surprise Win. Stock Jumped 8% After Hours

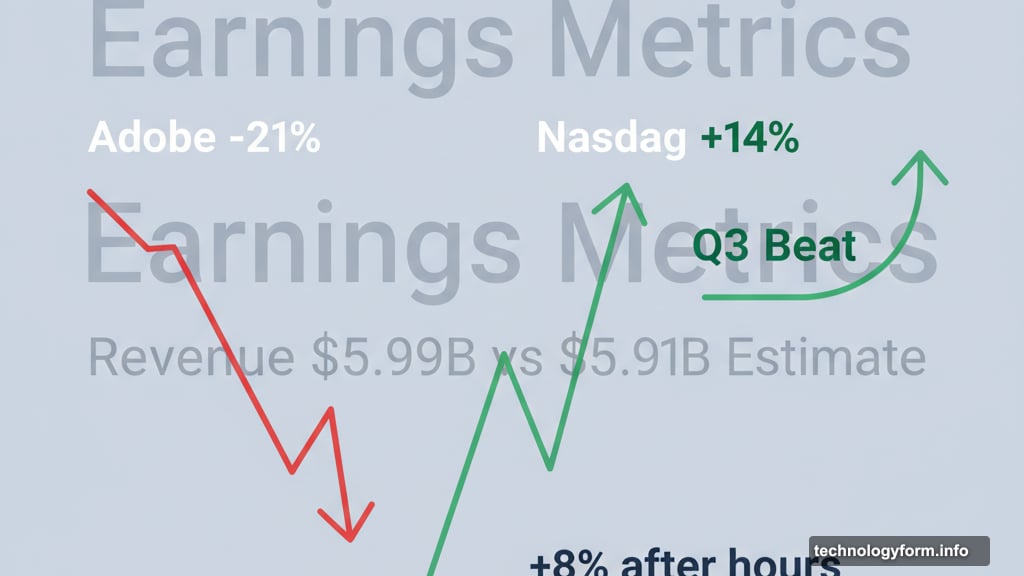

Adobe crushed expectations Thursday. The design software giant reported third-quarter earnings that beat analyst forecasts on both revenue and profit.

Investors responded immediately. Shares spiked over 8% in after-hours trading. That’s a big deal for a stock that’s been bleeding all year, down 21% while tech peers rallied.

So what changed? Adobe’s AI bet is finally paying off in real dollars.

The Numbers Tell a Clear Story

Adobe brought in $5.99 billion in revenue for the quarter ending August 29. Wall Street expected $5.91 billion. That’s an 11% jump from last year’s $5.41 billion.

But here’s the part that really matters. Earnings per share hit $5.31 adjusted, beating the $5.18 estimate. Plus, net income climbed to $1.77 billion from $1.68 billion year over year.

Those aren’t just incremental improvements. They represent Adobe executing better than most analysts predicted during a tough year for the stock.

AI Revenue Exploded Past Internal Targets

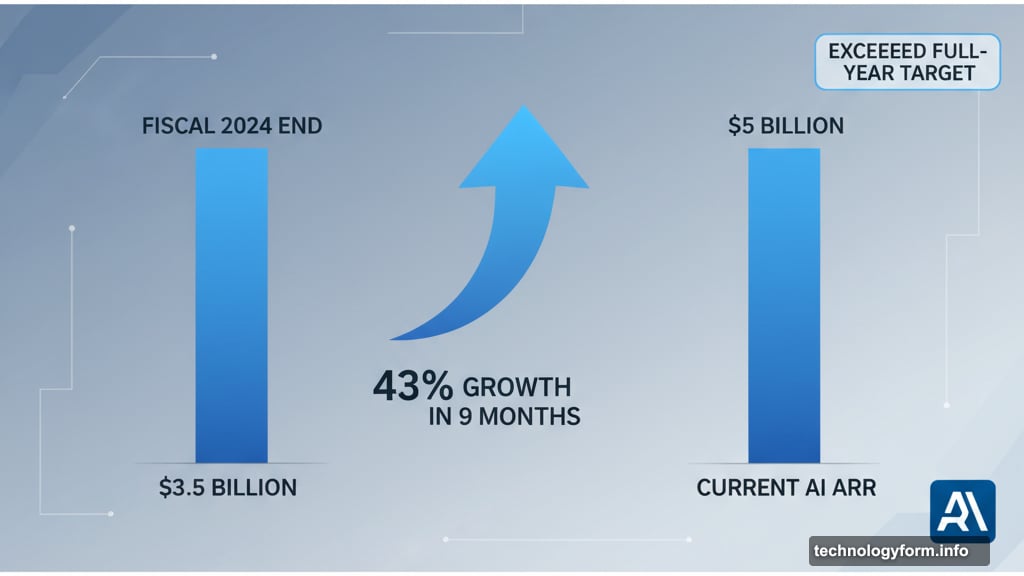

CEO Shantanu Narayen dropped the headline number on the earnings call. Adobe’s AI-influenced annual recurring revenue now exceeds $5 billion.

That’s up from $3.5 billion at the end of fiscal 2024. And it already surpassed their full-year target with one quarter still remaining.

Think about that trajectory. Adobe went from around $3.5 billion to over $5 billion in AI-related recurring revenue in roughly nine months. That’s 43% growth in less than a year.

For context, most software companies dream of that kind of acceleration in their core products. Adobe’s achieving it with features many skeptics dismissed as gimmicks when first announced.

Guidance Beats Expectations Too

Adobe isn’t just celebrating a good quarter. They’re raising the bar for what comes next.

Fourth-quarter earnings per share should land between $5.35 and $5.40. Analysts expected $5.34. Revenue guidance came in at $6.08 billion to $6.13 billion, matching the $6.08 billion consensus.

But the digital media segment tells the real story. Adobe now projects 11.3% annualized revenue growth for the fiscal year, up from their previous 11% forecast. Fourth-quarter digital media revenue should hit $4.53 billion to $4.56 billion, beating the $4.51 billion Street estimate.

These aren’t token increases. Adobe’s effectively telling investors their AI integration is working better than expected, and they see the momentum continuing.

Why This Matters After a Brutal Year

Adobe’s stock performance this year has been rough. Down 21% through Thursday’s close while the Nasdaq climbed 14%. Tech peers largely outperformed too.

Investors questioned whether Adobe could compete in the AI era. Competitors launched flashy generative tools. Startups grabbed headlines. Meanwhile, Adobe’s stock languished.

Thursday’s results flip that narrative. The company proved they can translate AI features into actual revenue growth. Not just hype. Not just user engagement metrics. Real dollars flowing through the business.

Moreover, the guidance suggests this isn’t a one-quarter fluke. Adobe sees sustained momentum, which is exactly what investors needed to hear after months of doubt.

The AI Integration Strategy Works

Adobe took a different approach than many competitors. Instead of launching standalone AI products, they baked AI directly into existing creative tools that millions already use daily.

Photoshop got AI-powered selection and generation features. Illustrator added AI assist for vector work. Premiere Pro integrated AI for video editing workflows.

This strategy minimized adoption friction. Users didn’t need to learn entirely new tools or workflows. They got AI enhancements in software they already knew.

Now the revenue numbers validate that approach. Customers are paying for these AI features. And they’re sticking around, as evidenced by the recurring revenue growth.

What Happens Next

Fourth quarter will determine whether Adobe sustains this momentum or experiences a temporary bump. The guidance suggests confidence, but execution matters.

The company needs to prove the AI features deliver enough value to justify premium pricing. They need to show customers aren’t just trying AI tools but making them core to their workflows.

Competition remains fierce. Rivals continue launching AI capabilities. Startups attract venture capital for generative tools. Adobe can’t rest on one good quarter.

But for now, the stock market is responding positively. An 8% after-hours jump suggests investors believe Adobe’s AI strategy has legs. Whether that optimism holds depends on maintaining this growth trajectory through year-end and beyond.

Adobe went from AI skeptic concern to AI revenue machine in less than a year. Not many legacy software companies pull that off. Thursday’s results show it’s possible when execution meets opportunity at the right moment.