Bitcoin Just Crushed $119K. Government Shutdown Fuels Rally

Bitcoin ripped through $119,000 this week. That’s its highest price in over two months.

The timing isn’t random. A U.S. government shutdown kicked in Wednesday, and crypto markets immediately caught fire. Plus, the chaos in Washington could accidentally create perfect conditions for Bitcoin to keep climbing.

Here’s what’s actually happening and why it matters right now.

Washington Chaos Creates Crypto Opportunity

Congress couldn’t agree on funding. So the government shut down Wednesday.

That might sound bad. But for Bitcoin? It’s actually bullish.

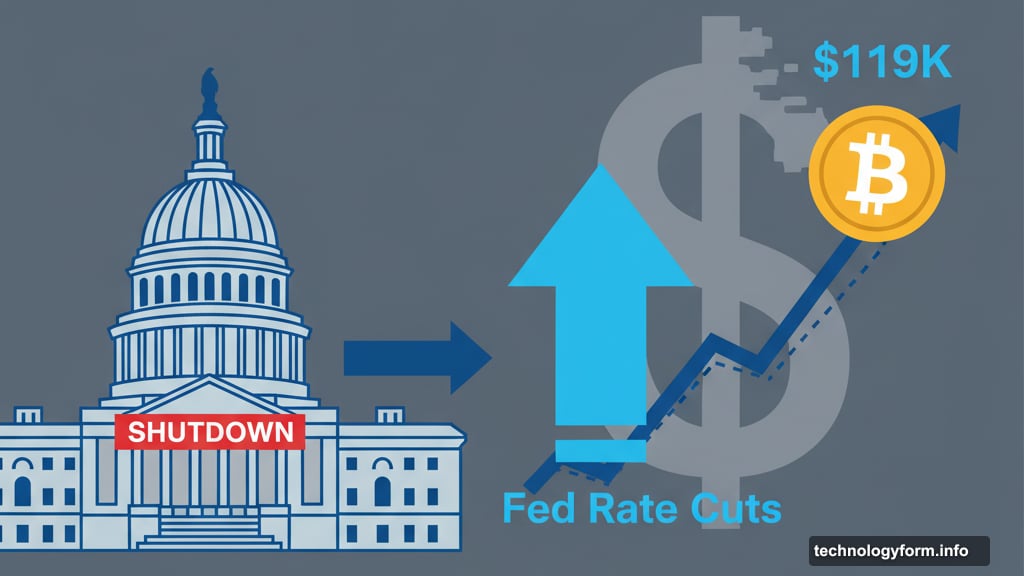

Here’s why. Friday’s jobs report—the one that helps the Federal Reserve decide interest rates—probably gets delayed. The Bureau of Labor Statistics can’t publish data during a shutdown.

No jobs data means the Fed flies blind. And when the Fed lacks information, it tends to play it safe. That usually means cutting rates to avoid economic damage.

Lower interest rates make Bitcoin more attractive. So this shutdown could accidentally boost crypto prices even higher.

Bitcoin Isn’t Alone in the Rally

Other major cryptos surged alongside Bitcoin. Ethereum jumped 4% in 24 hours. Solana climbed 7%. Even Dogecoin rallied 5%.

The CoinDesk 20 Index—which tracks major cryptocurrencies—shot up 5% to 4,217 points. That’s a broad-based rally, not just Bitcoin hype.

XRP gained particular attention with a 6% surge. It broke through key resistance levels that held for weeks.

Traders call this a risk-on environment. When traditional finance looks shaky, money flows into alternative assets. Bitcoin leads that charge.

Fed Rate Cuts Are Coming

Wednesday’s private payroll data looked terrible. Companies added far fewer jobs than expected.

That strengthens the case for Fed rate cuts. In fact, the Fed already cut rates by 25 basis points last month. More cuts are coming.

Matt Mena from 21Shares explains the connection. “If the jobs report gets delayed, the Fed likely delivers a 25 basis point cut in October. Plus, they’ll signal another potential cut by December.”

Lower rates reduce borrowing costs. They also weaken the dollar. Both factors historically boost Bitcoin prices.

Moreover, the Fed might slow its balance sheet reduction program. More money in the financial system? That’s exactly what Bitcoin needs to keep rallying.

Options Markets See Big Moves Coming

Smart money is positioning for explosive volatility. Bitcoin options on Deribit exchange look surprisingly cheap right now.

Greg Magadini from Amberdata points out the opportunity. “After a long dry spell for Bitcoin volatility, the government shutdown could finally make Bitcoin move significantly.”

He notes that the options market shows steep contango. That’s trader-speak for expecting much higher volatility soon. Near-term options are cheap relative to longer-dated ones.

So traders can buy options now at bargain prices. If Bitcoin makes a big move in either direction, those options pay off.

One popular strategy? The long straddle. You buy both call and put options at the same price. Profit comes from big price swings, regardless of direction.

Why This Shutdown Matters More

Previous government shutdowns barely moved crypto markets. This one feels different.

The timing coincides with weak economic data. Jobs numbers look shaky. Manufacturing is slowing. Consumer confidence is dropping.

Plus, the shutdown delays crucial economic reports. That creates information gaps right when the Fed needs clarity.

Mena from 21Shares calls this “a positive liquidity impulse.” He means the shutdown could force the Fed to pump more money into the system.

Bitcoin thrives on liquidity. More money circulating means more capital available for risk assets. Crypto sits at the top of that list.

In fact, Mena suggests this could mark “the next explosive leg higher in crypto markets.” That’s a bold call. But the data supports it.

Traditional Finance Looks Shaky

The dollar faces pressure from multiple angles. Government dysfunction erodes confidence. Rate cuts weaken the currency. Trade tensions add uncertainty.

Bitcoin gains when traditional currencies struggle. It offers an alternative that governments can’t manipulate or print endlessly.

Gold jumped alongside Bitcoin this week. Both assets serve as hedges against currency debasement. Both benefit from Fed rate cuts.

The correlation isn’t perfect. But the pattern holds. When faith in traditional finance wobbles, alternative assets rally.

Technical Picture Supports Bulls

Bitcoin broke through $119,000 resistance. That was a key level that held since mid-August.

The next resistance level sits around $125,000. Break through that, and Bitcoin challenges its all-time high near $140,000.

Trading volume surged during the rally. That suggests real buying pressure, not just speculative froth.

Moreover, on-chain data shows long-term holders accumulating. They’re buying despite higher prices. That signals confidence in further gains.

Short-term holders are selling into strength. But long-term believers are absorbing that supply. It’s a healthy pattern that supports sustained rallies.

Risk Factors Remain

Not everything points up. The government shutdown could end quickly. Congress might reach a funding deal and kill the bullish narrative.

If the jobs report publishes on time and shows strength? The Fed might pause rate cuts. That would hurt Bitcoin.

Plus, leverage in Bitcoin futures markets sits at elevated levels. A sharp reversal could trigger cascading liquidations.

Still, the near-term setup looks bullish. The combination of government chaos, weak economic data, and Fed dovishness creates ideal conditions for Bitcoin gains.

Watch Friday for signals. If the jobs report gets delayed, expect Bitcoin to test $125,000 soon. If data publishes and disappoints, same outcome. The only bearish scenario? Strong jobs data that changes the Fed’s trajectory.

Bitcoin isn’t reacting to tweets or hype anymore. It’s responding to real macroeconomic shifts. The government shutdown just accelerated trends already in motion.