Palantir Stock Crushed 1,700% Since 2020. Here’s What Actually Happened

Five years ago, Palantir went public during a pandemic. Nobody knew if the data analytics company would survive. Markets were crashing. Society was locked down. Plus, the company was bleeding money.

Today, Palantir trades at $182 per share with a $432 billion market cap. That’s a 1,700% gain that puts it among America’s 20 most valuable companies. It now outranks tech veterans like Cisco and IBM.

So what changed? The company figured out how to make money from government contracts and AI boom timing. But the story gets complicated fast.

Government Contracts Became Cash Machines

Palantir started in 2003 as a post-9/11 national security play. The company built software that helps organizations analyze massive data sets. Think intelligence agencies tracking terrorist networks or militaries coordinating operations.

The business model worked. Over five years, Palantir’s customer base exploded from 125 clients to 849. Revenue jumped almost sixfold to hit $4.2 billion this year. Moreover, the company finally turned profitable after years of losses.

Government deals drove most of that growth. Palantir partnered with the U.S. Army since 2008, embedding engineers directly with users. In fact, the company landed a $10 billion Army contract this summer for software and data services.

Defense spending keeps climbing. Palantir scored major contracts with organizations like ICE, the Pentagon, and various intelligence agencies. Plus, international deals with Ukraine and Israel’s militaries added billions more.

But here’s the controversial part. Critics slam Palantir for enabling government surveillance and immigration enforcement. Federal documents show ICE paid $30 million for tools providing “real-time visibility” on deportations. That sparked employee walkouts and public backlash.

CEO Alex Karp doesn’t apologize. He moved headquarters from Silicon Valley to Denver in 2020, fed up with what he called tech’s “monoculture.” His message to critics? Exit if you don’t like it.

AI Timing Saved Everything

Palantir’s stock crashed hard in 2022. Rising interest rates killed tech valuations across the board. Shares dropped to $6.42, well below the $10 debut price. Investors wondered if going public was a mistake.

Then ChatGPT launched in November 2022. Everything changed.

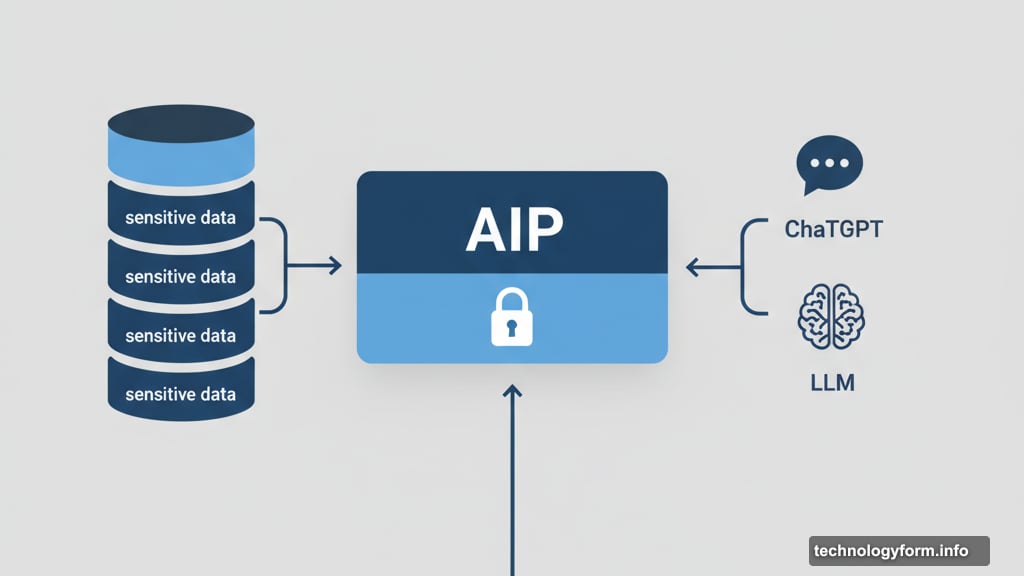

Palantir released its AIP platform in April 2023. The system lets organizations integrate large language models while handling sensitive data securely. So companies can use AI without leaking secrets or violating regulations.

AIP became a phenomenon. Commercial revenue from U.S. customers jumped 93% year-over-year last quarter. Total contract value surged 185% to $1.1 billion. Companies like Wendy’s, American Airlines, and auto supplier Lear signed deals.

Take Lear’s partnership. The manufacturer uses AIP to manage tariff exposure, automate workflows, and balance production lines. That’s practical AI application, not just hype.

Government agencies jumped on board too. The Pentagon increased Palantir’s Maven Smart Systems contract ceiling to $1.3 billion for AI capabilities. In fact, the military uses the platform to collect data from space sensors and coordinate ground operations.

“AI created a whole new set of risks,” said Akash Jain, Palantir’s technology chief. “The government had to rethink how it uses commercial technologies.”

Perfect timing met perfect positioning. Palantir already had security clearances, government relationships, and infrastructure. So when AI exploded, the company captured deals competitors couldn’t touch.

The Valuation Makes No Sense

Wall Street keeps screaming about Palantir’s price. The stock trades at 226 times forward earnings. That’s a forward revenue multiple of over 80. Even Tesla, known for absurd valuations, only trades at 194 times earnings.

Short-seller Andrew Left called Palantir “detached from fundamentals” in a recent report. He argues the company should trade around $40 per share based on OpenAI’s valuation metrics. That’s less than one-quarter the current price.

“Karp and his team should be proud,” Left wrote. “But when measured against true AI leaders, Palantir’s price already reflects success beyond its fundamentals.”

Karp’s response? He told critics to leave if they hate the valuation. “We are going to be the most important software company in the world,” he said during the NYSE debut. “People will figure out what that’s valued over a long period of time.”

Investors don’t seem concerned yet. The stock jumped 341% in 2024 and climbed another 141% so far this year. Plus, Palantir joined the S&P 500 last year, replacing American Airlines. That brought institutional money flooding in.

Still, the math looks scary. Revenue needs to keep growing at triple-digit rates to justify current prices. Any slowdown could trigger massive selloffs. Meanwhile, government contracts remain the dominant revenue source. That creates concentration risk if political winds shift.

Controversy Won’t Stop Growth

Palantir faces constant criticism about surveillance and military applications. The company helps ICE track immigrants. It provides targeting data to foreign militaries. Moreover, reports claim Palantir helps gather data on Americans.

The New York Times ran investigations about government data collection. Palantir called the reporting “reckless and irresponsible.” Karp insisted the company doesn’t surveil Americans, though he admits tools could be misused.

Some employees quit over ethical concerns. Karp took out a full-page ad in the Times supporting Israel after the October 7 attacks. He knew that would cost him workers. He didn’t care.

“It’s not just about Israel,” Karp told CNBC. “It’s like, ‘Do you believe in the West? Do you believe the West has created a superior way of living?'”

That attitude defines Palantir’s culture. The company positions itself as defender of Western values against authoritarian threats. So government work isn’t just profitable. It’s ideological.

Critics won’t change the trajectory. Defense spending keeps rising globally. AI capabilities become more critical every year. Plus, Palantir already holds security clearances and relationships that take competitors decades to build.

What Happens Next Matters More

Palantir proved skeptics wrong over five years. The company went from pandemic-era direct listing to S&P 500 member. Revenue quadrupled. The stock crushed every major index.

But maintaining that momentum gets harder. Commercial growth must accelerate to reduce government dependence. AIP needs to keep attracting corporate customers despite competition from Microsoft, Google, and Amazon.

Moreover, the valuation leaves zero room for error. Any earnings miss or guidance cut could trigger 30-50% drops. Remember, this stock already lost two-thirds of its value in 2022. It could happen again.

Still, Palantir’s position looks strong. Few companies can match its government relationships, security infrastructure, and AI integration capabilities. So the question isn’t whether Palantir succeeds. It’s whether success justifies the current price.

Karp believes it does. He thinks Palantir becomes the most important software company in the world. Maybe he’s right. Maybe he’s delusional. Either way, the next five years will be wild.